Introduction: why specialist assessments still matter

AI is transforming claims management, but even the most advanced systems can’t fully replace medical expertise. While AI and structured data help claims handlers conduct many medical assessments independently—making desktop assessments—specialist assessments remain critical for accurate settlements of complex personal injury claims.

For claims leaders, the challenge isn’t just ensuring access to medical specialists—it’s building a scalable, cost-effective, and consistent process that supports both operational efficiency and strategic decision-making.

This article outlines how Mavera DSS helps insurers modernize and streamline their specialist assessments.

The strategic burden of outdated specialist assessment processes

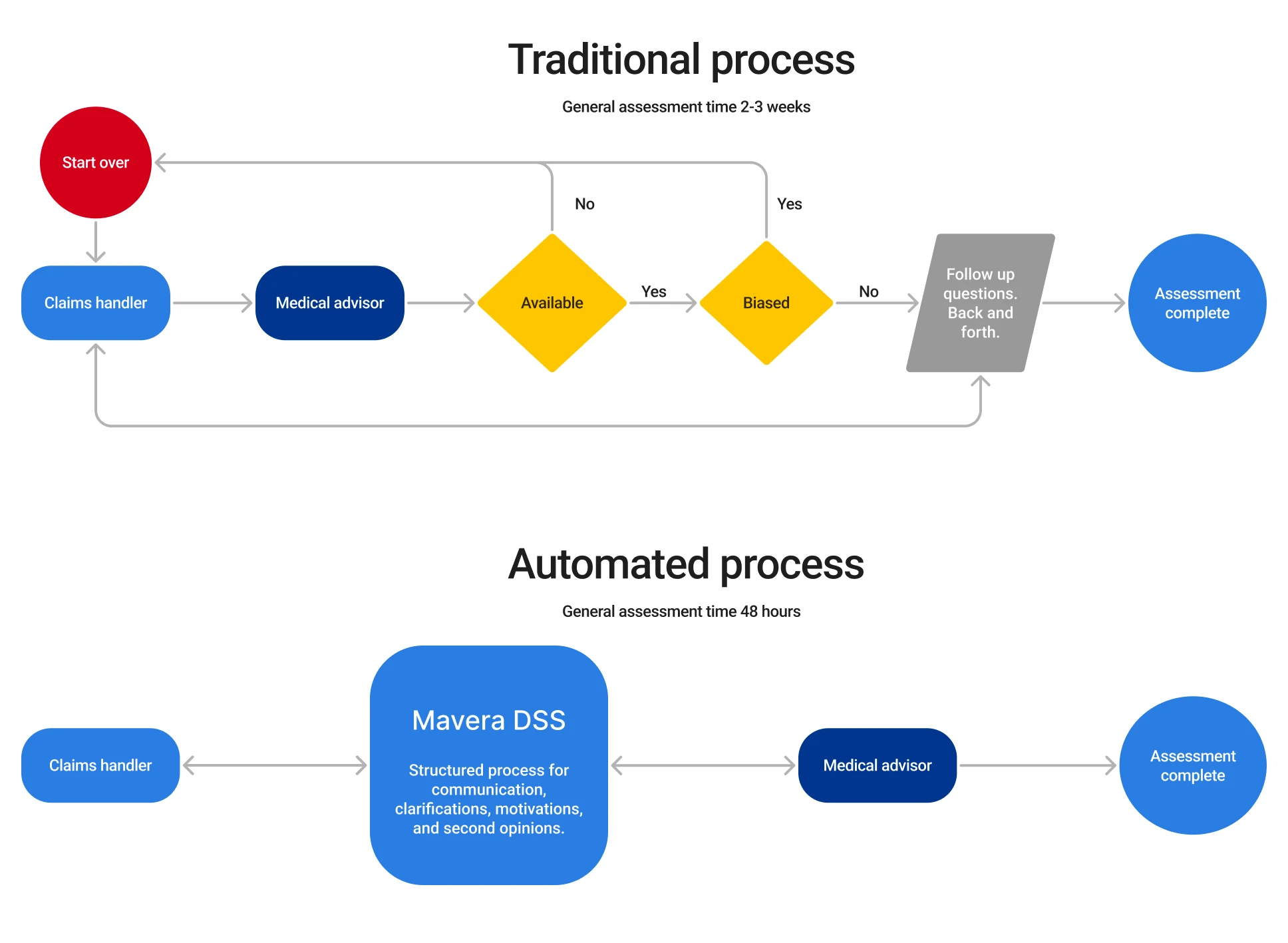

Historically, requesting a specialist assessment has been a manual and inconsistent process:

- Claims handlers email doctors directly, often facing delays or unanswered messages

- Specialist availability varies, causing bottlenecks and missed SLAs

- Communication happens over email, posing security risks and compliance issues

- There is little transparency or structured feedback on performance or cost-effectiveness

With a traditional process, specialist assessments become a burden rather than a support.

A smarter process with Mavera DSS

Mavera DSS replaces these fragmented processes with a unified, secure, and intelligent workflow. Whether using your own network of specialists or Mavera’s external network—or both in parallel—you gain structure, speed, and control.

Key benefits include:

- Automated case assignment based on specialty and availability

- Secure sharing of documentation within a GDPR-compliant platform

- Integrated communication tools, such as built-in chat and notifications

- Second opinions and bias checks built into the workflow

- Performance analytics to track turnaround times, clarification rates, and advisor efficiency

This structure turns the specialist assessment process into a scalable strategic asset—not an administrative bottleneck.

“Since using Mavera DSS, we have cut the average number of case touches (number of times a case is opened for a new action) by 50%. Shorter handling times, more satisfied customers, and internal efficiency gains is an obvious triple win,”

says Oskar Norman, claims manager at Sensor Försäkring.

Why scale matters in specialist networks

To make well-founded decisions, insurers need access to specialists across every relevant medical discipline—orthopedics, neurology, psychiatry, etc.—and preferably multiple experts within each area for flexibility, second opinions, and workload balancing.

But scale is difficult to achieve alone.

Most insurers rely on fewer than 10 in-house generalists for all types of assessments. That can lead to:

- Increased risk of inaccurate assessments due to lack of specialized expertise

- Longer cycle times, as limited resources create queues

- Reduced trust, as claimants may question the objectivity of assessments from in-house doctors

The case for an external network

Mavera offers the largest network of medical specialists in the Nordics, with over 300 certified professionals across all disciplines. Our rigorous recruitment, training, and quality assurance processes ensure reliable and independent assessments—delivered with a standard response time of 48 hours.

Benefits of outsourcing to Mavera’s network:

- Instant scale without internal overhead

- Reduced administrative burden—no need to recruit, onboard, or manage payments

- Greater objectivity—external specialists minimize perceived conflicts of interest

- Consistent turnaround times, even during peak periods

Hybrid flexibility: combine internal and external specialists

You don’t have to choose between building your own network or outsourcing entirely. Many of our customers use both their internal doctors and Mavera’s network side by side in Mavera DSS.

This hybrid setup lets you:

- Maximize coverage and availability

- Optimize cost and resource allocation

- Gain complete statistics and reporting across all your specialist assessments

All workflows—internal or external—run through the same structured platform, so you maintain control and transparency regardless of source.

Data-driven leadership and continuous improvement

With Mavera DSS, every part of the specialist assessment process is tracked. That gives you:

- Actionable dashboards on turnaround times, usage patterns, and costs

- Insights into network performance, advisor performance, and process bottlenecks

- A foundation for ongoing optimization, strategic management, and improved customer outcomes

Summary: a leadership imperative

Specialist assessments remain essential for accurate claims handling—but they don’t have to be slow, opaque, or costly.

By streamlining your processes with Mavera DSS and ensuring access to the right experts at scale, you can:

- Reduce cycle times

- Improve accuracy

- Increase transparency

- Free up claims handlers to focus on their core tasks

- Strengthen customer trust

In short, you elevate a historically manual and inconsistent process into a source of strategic advantage.