So, you’ve heard that Mavera DSS is a cloud platform that helps insurers make their claims process faster and more accurate—but what does that really mean in practice?

This article is for you.

Where does Mavera DSS fit into the claims process?

Mavera DSS is designed for any claim involving an injured or ill person—whether it’s a traffic accident, travel insurance, workers’ compensation, medical malpractice, maternity insurance, or accident and health insurance.

DSS stands for Decision Support System, and that’s exactly what it provides: structured, intelligent support throughout key stages of the claims process.

It’s especially valuable for injury-related claims, where medical information is complex and decision-making depends on expert input or analysis.

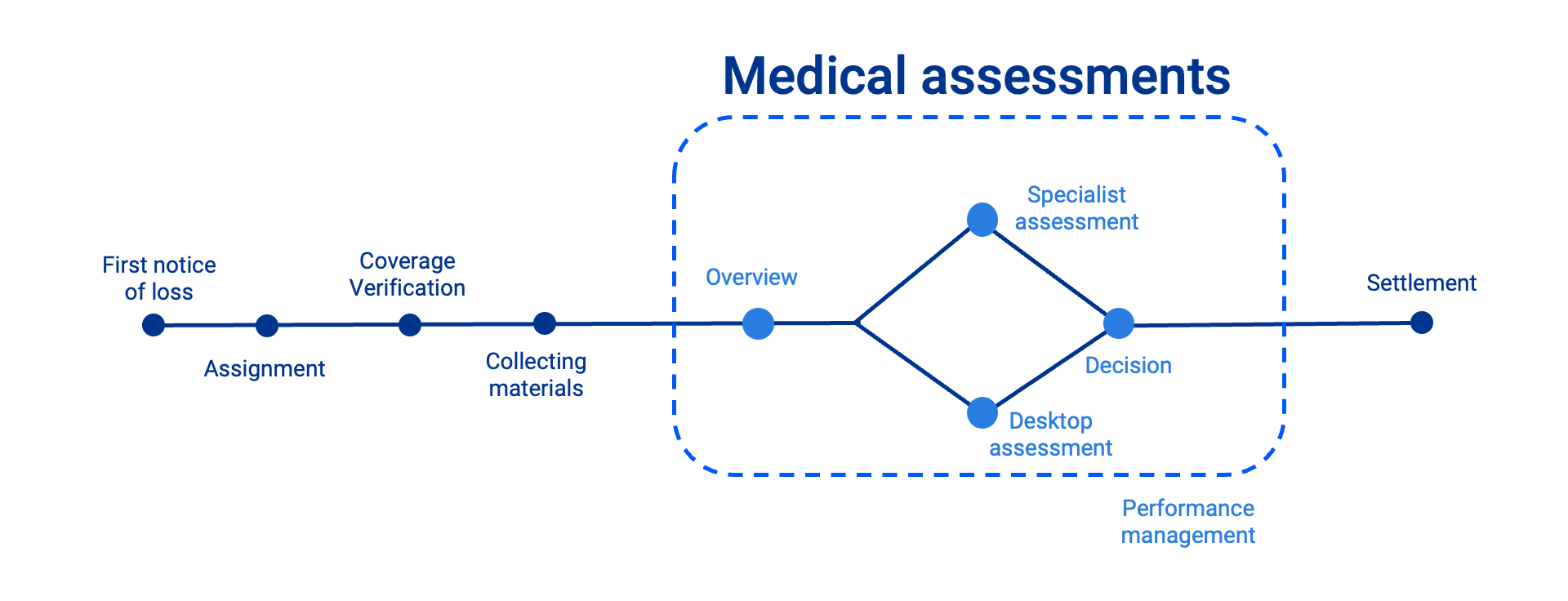

Here’s a typical claims process:

- First notice of loss (FNOL)

- Claim assignment

- Coverage verification

- Documentation upload

- Understanding the injury and performing desktop assessments

- Medical assessment (if needed)

- Decision making

- Process optimization and reporting

Mavera DSS enhances steps 4 to 8, starting the moment documentation is uploaded and continuing through decision-making, reporting, and continuous improvement.

Health insurance follows a slightly different process; read more about how we support health insurance here

Step 4: Upload documentation and get instant insight

The moment a claim’s documentation is uploaded into Mavera DSS, the system gets to work. Using AI, it reads through hundreds of pages—medical records, reports, physician notes—and produces a clear, structured overview of the case.

Claims handlers can instantly:

- View a summary of the claimant’s medical history

- See a timeline of key medical events

- Analyze lists and graphs of health markers

- Identify missing documents or red flags

Instead of spending hours digging through PDFs, claims handlers gain immediate insight into the injury and can quickly decide on next steps—such as proceeding with a desktop assessment or referring the case to a medical advisor.

See how it works in this 2:30-minute video, or read more here.

Step 5: Desktop assessments – faster, independent decisions

Many claims can be assessed without involving a medical specialist. For example, claims with low or no permanent disability, recurring injuries without complications, or other straightforward assessments.

With the new desktop assessment features in Mavera DSS, experienced claims handlers can assess simpler claims on their own—directly in the system. AI helps by summarizing documentation, highlighting key details, and guiding the handler through a structured workflow.

This shift not only saves time and cost but also empowers claims handlers to take more responsibility, while still ensuring quality and accuracy.

If the case is more complex, it’s easy to escalate it to a medical advisor within the same system.

Read how we support desktop assessments

Step 6: Getting medical assessments – when needed

Mavera DSS also helps streamline medical assessments. Whether you’re using your own network of advisors or ours, the system makes the process seamless:

- Automatically assign cases based on specialty and availability

- Share documentation securely within the platform

- Communicate via integrated chat

- Track turnaround times and performance

Mavera DSS includes access to the largest medical advisor network in the Nordics—but you can also manage your own experts, or combine both setups.

See how it works in this 2-minute video, or read more here.

Step 7: Decision making and transparency

Once all information is reviewed, the claims handler can make a decision. Mavera DSS enables collaboration, second opinions, and full traceability—so that decisions are well-founded and auditable.

The system also generates a clear decision report that can be shared with the claimant, enhancing transparency and trust.

Step 8: Monitor, improve, and scale

Behind every decision is data. Mavera DSS continuously collects and visualizes key performance indicators—from processing times to advisor usage and common claim types.

Dashboards and reports help you:

- Identify bottlenecks

- Benchmark performance

- Improve workflows

- Make data-driven decisions

This kind of insight is critical for insurers looking to scale operations while keeping control over quality and cost.

Read more or watch this 1-minute video about our claims reports.

The results

Insurers using Mavera DSS report:

- Up to 10x faster handling times, enabling teams to process more claims with fewer delays

- More accurate decisions, reducing overpayments and legal disputes

- Better use of structured data, improving both day-to-day operations and strategic planning

- Ensured compliance with GDPR and DORA, simplifying audits and reducing risk

The result? Lower loss adjustment expenses, reduced claims payouts, fewer litigations—and a smoother experience for your team and your customers.

A smarter path to better claims decisions

Mavera DSS is built to help insurers adopt AI and automation without complexity. As a SaaS solution, it can be integrated into your core system or used standalone for fast implementation.

Whether you’re looking to speed up simple claims or bring order to complex ones, Mavera DSS provides end-to-end support—from documentation to decision.

Ready to transform your claims process? Schedule a demo to see Mavera DSS in action.